There has been a significant uptick in aquisitions in the first four months of 2018 providing interesting insights about the current value of information companies:

There has been a significant uptick in aquisitions in the first four months of 2018 providing interesting insights about the current value of information companies:

-

- Experian acquired ClearScore for £275 million (US$385 million) valuing the company at an implied 7x budgeted revenue. The company expects to grow revenue by 50% in 2018. For details click here.

- TransUnion agreed to acquire Callcredit for £ 1 billion (US$1.4 billion) signaling its entry into Europe. Callcredit 2016 revenues were £201 million, valuing the company at approximately 5x 2016 revenues. For details click here.

- S&P Global agreed to acquire Kensho Technologies for US$550 million, valuing the company at an implied 28.2x LTM revenue. For details click here. “Kensho’s capabilities are critical for S&P Global to be at the forefront of the technology transformation taking place within the financial markets and it will accelerate multiple commercial and efficiency opportunities. S&P Global’s strategy is focused on strengthening our technology capabilities across the enterprise.”

- Salesforce clinched one of the largest tech deals in the first quarter by agreeing to acquire MuleSoft for US$6.1 billion valuing the company at an implied 22.3x LTM revenue. For details click here.

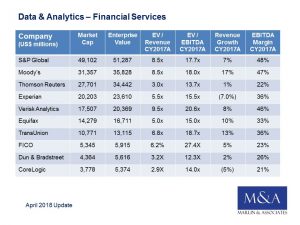

The latest comparison of the market caps, enterprise values and revenue multiples are listed below.

Source: Press Releases and Marlin & Associates April 2018 General Market Update.