Activist investors from hedge fund Jana and the Ontario Teachers Pension Fund (“Teachers”) have bought 5.2% of McGraw-Hill Corporation with the avowed intent of forcing the division of the company into a financial services company and an educational/B2B company.

Activist investors from hedge fund Jana and the Ontario Teachers Pension Fund (“Teachers”) have bought 5.2% of McGraw-Hill Corporation with the avowed intent of forcing the division of the company into a financial services company and an educational/B2B company.

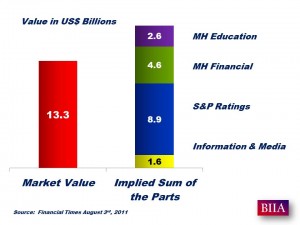

The activist investors believe that the sum of the parts could be as high as US$17.7bn, while the current market value of McGraw-Hill is US$13.3bn. The news prompted a 7.3% jump in McGraw-Hill’s shares.

McGraw-Hill has not been idle and had begun a comprehensive portfolio review some time ago. In its second quarter analyst call Harold ‘Terry’ McGraw-Hill said ‘everything was under review and that one should expect a number of significant actions in the second half of this year’. To read David Worlock’s assessment click on the link below.

Source: Financial Times and David Worlock